What is Net Working Capital NWC Definition, Types and Formula

A ratio above two may mean you can invest cash in your business, pay down debt, or distribute it to owners. Run a cash flow projection to confirm this and decide whether you want to keep the cash for safety or invest it for higher profits. The factoring company pays you right away and then waits for payment from the customer. There’s no debt or interest to pay back, so it doesn’t lower your net working capital, and you can put that money to use for your business right away. If you’re selling your software business, it’s essential to understand key financial variables that may impact the process. However, when it comes to mergers and acquisitions, calculating NWC and determining a normalized level for the business can be much more nuanced than it appears on the surface.

Working Capital Change Formula

By following these steps, you can accurately calculate your net working capital and then determine any changes over time. The change in net working capital refers to the difference between the net working capital of a company in two consecutive periods. It is calculated by subtracting the net working capital of the earlier period from that of the later period. Upon inserting the provided historical data into the formula, the operating income (EBIT) of our company comes out to $45 million (and operating margin of 45%).

Operating Cycle View

- Now, say for example, your company has cash and cash equivalents of INR 1,10,000, accounts receivable of INR 50,000, and other prepaid expenses that are worth INR 30,000.

- In this scenario, the company’s net working capital decreases, signaling potential cash flow constraints and liquidity challenges.

- If a company has a low ratio relative to its peers, then it’s not selling many products from its inventory and its inventory management is likely inefficient.

- Working capital might sound the same as cash flow (both figures reflect your business’s financial state), but there is a key difference.

- These accounting intricacies, as it turns out, are open to negotiation.

You may want to consider a small business term loan or open a business line of credit if you have liabilities that need to be paid. Improving NWC involves optimizing various operational and financial aspects. Companies can focus on reducing accounts receivable collection times, negotiating favorable payment terms with suppliers, managing inventory efficiently, and closely monitoring cash flow. These measures can enhance NWC and contribute to better financial stability. This formula provides a more focused assessment of the funds necessary to support a company’s day-to-day business operations.

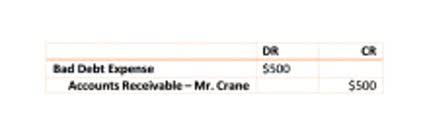

Download Your FREE PDF Copy: Food and Beverage M&A

As you can see, working capital is 250% higher ($2.5 million vs. $1 million) in the busy season than the off-season. For the seller, aggressively collecting your receivables is an opportunity to realize additional value, but only if you do so for several quarters before you begin the sales process. For example, many businesses don’t maintain an allowance (or reserve) for bad debt, an omission the buyer may discover during due diligence. If maintaining a reserve is industry practice, an adjustment should be made to NWC to include one.

A Breakdown of Working Capital Formulas

If you’re recording accounting transactions manually, you’ll need to add the appropriate account balances in your general ledger to arrive at current asset and current liability totals. Net working capital gives you and your investors a good snapshot of the financial health of your business. One of the easier accounting formulas to calculate, even entry-level bookkeepers will be comfortable calculating NWC.

The Working Capital Cycle

Lenders want to know if a business can repay its debts on time, whereas investors will be keen to see returns on their money, which a decent working capital can help. The working capital peg is usually first estimated at the LOI stage of an M&A transaction. This preliminary calculation is a starting point for the process and, like many terms in the LOI, isn’t legally binding. The final working capital calculation is made 90 to 120 days after closing and any difference is reconciled between the parties via a purchase price adjustment. Most acquisitions occur on a cash-free, debt-free basis – the result is that cash and cash equivalents are not included in the calculation of working capital.

- Owners commit cash and aren’t promised when, or even if, they will be repaid.

- Both require you to have a healthy cash flow and liquid assets, or working capital.

- It’s a calculation that measures a business’s short-term liquidity and operational efficiency.

- The often-used current ratio, as an indicator of liquidity, is seriously flawed because it’s conceptually based on the liquidation of all a company’s current assets to meet all of its current liabilities.

- In the absence of further contextual details, negative net working capital (NWC) is not necessarily a concerning sign about the financial health of a company.

- You’ll collect money faster, which may be more valuable than the 1% to 2% you lose when the customer takes the discount.

- On the other hand, a negative NWC means that a company will typically need to borrow or raise money to remain solvent.

- You can also use another formula to calculate your company’s net working capital.

- Operating Working Capital (OWC) measures the current assets and current liabilities used as part of a company’s core, day-to-day operations.

- Whatever its size, the amount of working capital sheds very little light on the quality of a company’s liquidity position.

- One of the most common ways businesses get into a cash crunch is by using short-term debt to finance long-term investments.

- It excludes items that may not be directly linked to the core operations, such as short-term investments or non-operating assets that might be included in the traditional NWC calculation.

Meanwhile, investors will likely consider investing in companies that have healthy free cash flow profiles, which should ultimately lead to promising futures. Combined with undervalued share prices, equity investors can generally nwc equation make good investments with companies that have high free cash flow. Investors greatly consider FCF compared to other measures, because it also serves as an important basis for stock pricing and the ability to service debt.

EBITDA Calculation Example (Bottom-Up Bridge)

- It refers to the difference between your company’s total current assets and total current liabilities.

- If that happens, then the business would have to raise financing to pay off even its short-term debt or current liabilities.

- At first glance, a result of 1.25 (or 125%) seems encouraging, since Company D obviously has more than enough money in current assets to cover its current liabilities.

- If you can’t generate enough current assets, you may need to borrow money to fund your business operations.

- This indicates the business has too many inventories and is struggling to sell those.

- Below, we will walk through each of the steps required to derive the FCF Formula from the very beginning.

Work with advisors to analyze and understand your company’s NWC ahead of time to strengthen your negotiating position. Given the step function used in our model, the formula to calculate the incremental NWC is constant. In the next section, the change in net working capital (NWC) – i.e. the increase / (decrease) in net working capital (NWC) – will be determined. Generally, companies should avoid the ratio from becoming too high, which is a subjective measure and entirely dependent on the industry. The company thus has a net working capital of Rs. 60,000, an amount that it can use for its short-term obligations.